Applications of bayesian modelling in finance

Modelling finance from the ground-up

GARCH-like model

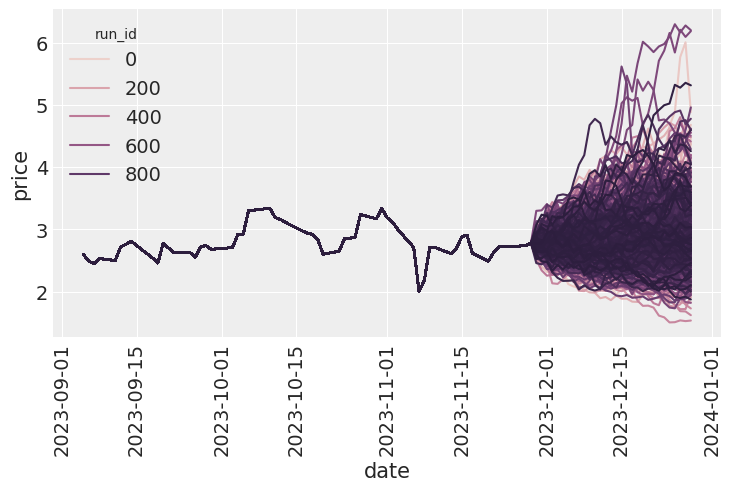

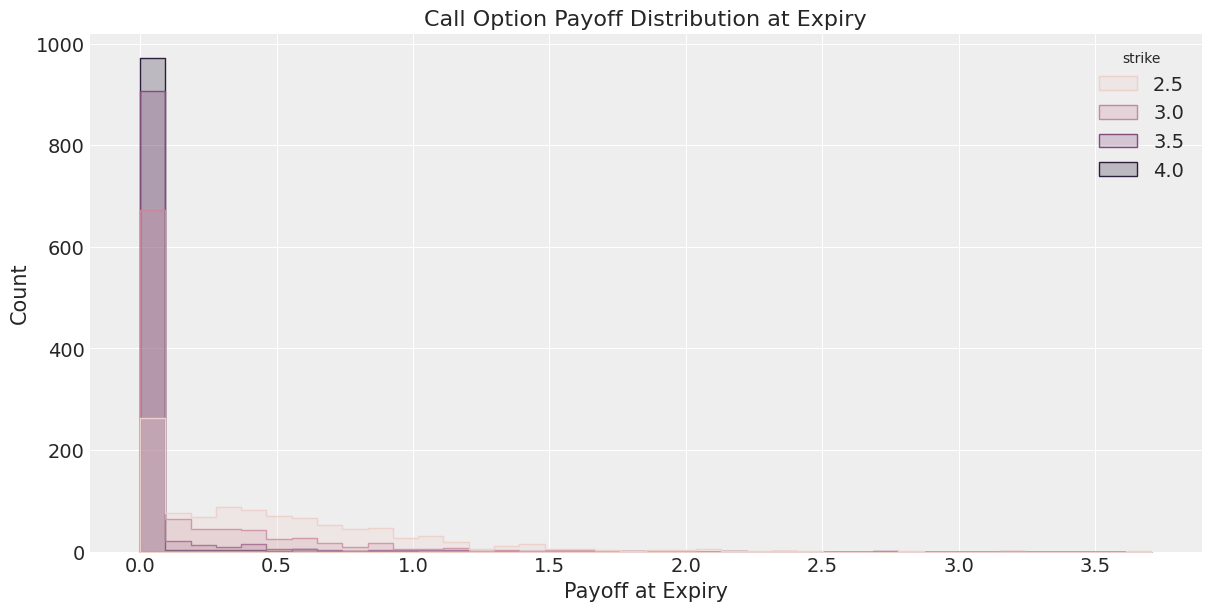

This project explores a generative approach to pricing natural gas options using a Bayesian GARCH-inspired model. It uses NumPyro to model volatility dynamics from historical data, simulates future prices, and estimates option payoffs under different strike scenarios.

It’s not a production-grade system, but a sandbox to understand how volatility-aware models behave—and how they might be extended further.

I decided to go for the following process of modelling the log returns:

\[ \begin{align*} \log r_t &\sim \mathcal{N}(\mu_t, \sigma_t^2) \\ \mu_t &= \alpha_0 + \sum_{i=1}^S \alpha_i \log r_{t-i} \\ \sigma_t^2 &= \beta_0 + \sum_{i=1}^S \beta_i \sigma_{t-i}^2 \end{align*} \]

- 📊 Loads and engineers features from natural gas price time series

- ⚙️ Bayesian model for log returns and autoregressive variance

- 🔁 Generates future price paths via simulation

- 💰 Computes call option payoffs & model-implied prices

- 🔍 Fully implemented in NumPyro with MCMC inference

Simulated Price Paths

Call Option Payoffs at Expiry

Model-Implied Option Prices vs Strike